Japan’s exports rose for a third straight month in November, government data showed on Wednesday, as shipments to the United States rebounded for the first time in eight months, bolstering the case for the central bank to continue raising interest rates in response to improving economic conditions and resilient external demand despite ongoing trade tensions and global economic uncertainties.

Total exports by value rose 6.1 percent year-on-year last month to JPY 9.71 trillion, representing the fastest growth in nine months and more than a median market forecast for a 4.8 percent increase while following a 3.6 percent gain in October. The strong performance reflects Japan’s gradual recovery from the economic contraction experienced in the third quarter and demonstrates the resilience of Japanese exporters in navigating a complex global trade environment characterized by protectionist pressures and shifting supply chains.

Exports to the United States rose 8.8 percent in November from a year earlier to JPY 1.82 trillion, marking the first time that exports to America have increased in eight months and signaling potential stabilization in bilateral trade following months of tension over tariffs and trade imbalances. Meanwhile, shipments to mainland China fell 2.4 percent, continuing a pattern of weak demand from Japan’s largest Asian trading partner, though exports to Hong Kong jumped 11.4 percent compared to the same period the previous year, partially offsetting the decline in mainland Chinese orders.

Build the future you deserve. Get started with our top-tier Online courses: ACCA, HESI A2, ATI TEAS 7, HESI EXIT, NCLEX-RN, NCLEX-PN, and Financial Literacy. Let Serrari Ed guide your path to success. Enroll today.

Trade Surplus Returns After Five-Month Deficit

Imports grew a modest 1.3 percent last month year-on-year to JPY 9.39 trillion, falling short of market forecasts for a 2.5 percent increase and reflecting relatively subdued domestic demand amid persistent inflation concerns and cautious consumer spending. The slower import growth, combined with robust export performance, enabled Japan to post its first trade surplus in five months in November, with official figures suggesting that external demand is beginning to offset persistent weaknesses in trade with China and higher import volumes from Europe.

As a result, Japan ran a trade surplus of 322.3 billion yen ($2.08 billion) in November, dramatically exceeding the market forecast of 71.2 billion yen and marking a significant turnaround after several months of deficits that had raised concerns about Japan’s external position. The surplus totalled approximately $2 billion, providing breathing room for policymakers and reinforcing confidence in Japan’s export competitiveness despite the headwinds from elevated tariffs on Japanese goods entering the American market.

Trade with the United States showed particular improvement across multiple product categories. Japan recorded a trade surplus of nearly JPY 740 billion with America, the first expansion in seven months, aided by a rebound in automobile shipments and a fading impact from previously imposed tariffs. Automobile exports to the US, which had been under significant pressure, posted a recovery with auto shipments rising 1.5 percent year-on-year in November, though total automobile exports by value fell 4.1 percent globally, indicating continued challenges in other markets.

By contrast, trade with China remained a persistent drag on Japan’s overall export performance. Japan ran a deficit of almost JPY 778 billion with its largest Asian neighbor, extending a long sequence of monthly shortfalls and underlining the uneven nature of its external recovery. Exports of foodstuff to mainland China fell 5.9 percent by value, reflecting heightened tensions between the two nations after Japanese Prime Minister Sanae Takaichi stated that a Chinese attempt to seize Taiwan by force could trigger an intervention by Japan’s military, prompting Beijing to restrict imports of Japanese seafood products.

Regional Export Performance and Sectoral Dynamics

The export growth was particularly supported by a 23.6 percent increase in goods shipped to Western Europe, demonstrating strong demand from European markets despite economic slowdown concerns in the region and benefiting from the continued weakness of the yen which makes Japanese products more competitive on price. The rise was driven by stronger sales of semiconductors and electronic components to Asian markets alongside pharmaceutical exports to the United States, reflecting Japan’s continued strength in high-value technology sectors.

According to reports, imports from the United States rose more than 7 percent, while higher purchases of engines from the European Union as well as chips and related parts contributed to the modest overall import growth. The composition of Japan’s import basket continues to reflect the country’s dependence on foreign energy sources and advanced technology components that feed into its sophisticated manufacturing ecosystem.

US-Japan Trade Agreement Provides Tariff Relief

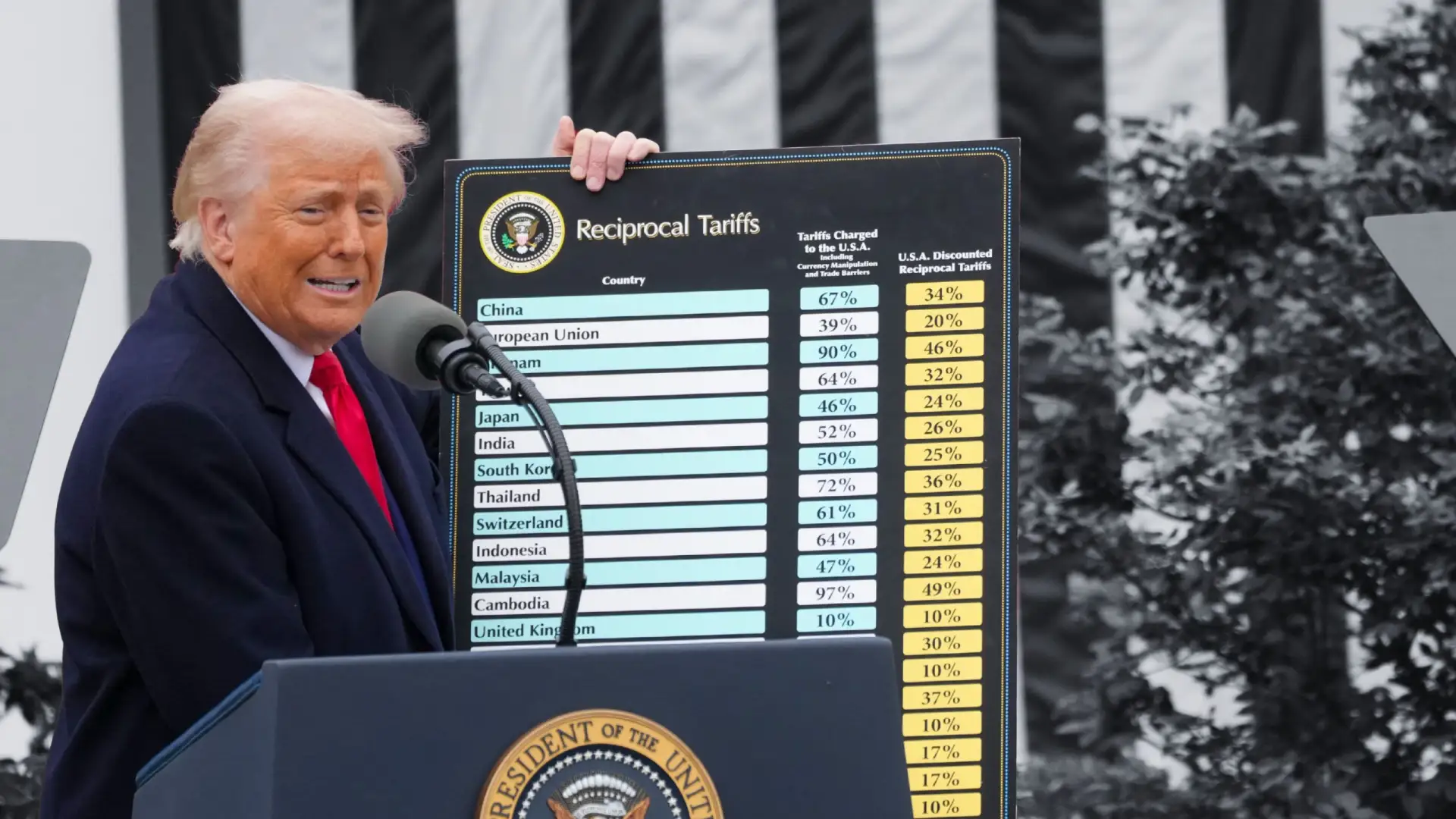

The improving export environment reflects significant progress in resolving trade frictions with the United States that had threatened to severely damage bilateral economic relations. Relief came after the United States and Japan formalized a trade agreement in September that implemented a baseline 15 percent tariff on nearly all US imports from Japan, representing a substantial reduction from an initial threat of 27.5 percent on automobiles and 25 percent on most other goods that had been proposed by President Donald Trump earlier in the year.

The agreement was reached in July 2025 following months of intense negotiations spurred by US tariff actions, with details of the framework agreement released in early September after further talks to resolve differences over implementation terms. On September 4, President Trump issued Executive Order 14345 to implement tariff adjustments as part of the US-Japan framework agreement, with the new tariff rates taking effect beginning September 16, 2025.

Under the executive order, all Japanese automobiles and auto components entering the United States face a minimum 15 percent tariff, unless their current most-favored-nation rate is already at or above that level, in which case no additional duties are imposed. The order provides targeted exemptions for aerospace products covered under the World Trade Organization Agreement on Trade in Civil Aircraft except unmanned aircraft, certain natural resources not produced domestically, and generic pharmaceuticals, which receive zero tariff treatment.

As part of the comprehensive deal, Tokyo agreed to invest $550 billion in projects selected by the US government and ramp up its purchase of American agricultural products including corn and soybeans, as well as US-made commercial aircraft and defense equipment. Japan also committed to purchase $8 billion annually of US agricultural goods including fertilizer and bioethanol, $7 billion in annual purchases of US energy, and an easing of Japanese regulations for US-safety-certified vehicles along with provision of clean energy vehicle subsidies for American automobiles.

The tariff relief applies retroactively to Japanese goods “entered for consumption or withdrawn from warehouse for consumption on or after 12:01 a.m. eastern daylight time on August 7, 2025,” according to the executive order, with the tariff relief on automobiles taking effect seven days after the order’s issuance. The retroactive application created opportunities for refunds on duties paid at higher rates, providing financial relief to Japanese exporters who had absorbed significant cost increases during the period of elevated tariffs.

Japanese Exporters Demonstrate Resilience

Japan’s economy shrank 0.6 percent quarter-on-quarter in the third quarter, contracting 2.3 percent on an annualized basis as exports slumped under the weight of US tariffs that had been imposed before the bilateral agreement was finalized. The revised GDP numbers showed that Japan’s economic contraction was more severe than initially estimated, highlighting the significant economic impact of the trade tensions that had dominated the first half of 2025.

However, analysts expect growth to rebound in the current quarter based on the improving trade data and stabilization of external demand. The initial shock from higher tariffs proved milder than feared, as Japanese exporters absorbed significant portions of the tariff costs to stay competitive in the critical American market, aided by a weaker yen that provided a natural hedge against the price increases imposed by tariffs.

The yen’s depreciation throughout much of 2025 has been a double-edged sword for Japan’s economy – while it increases the cost of imports and contributes to inflation, it simultaneously enhances the price competitiveness of Japanese exports in foreign markets. Japanese manufacturers have demonstrated remarkable adaptability in managing tariff pressures through a combination of cost absorption, supply chain optimization, and strategic pricing decisions that preserve market share while maintaining acceptable profit margins.

One decision can change your entire career. Take that step with our Online courses in ACCA, HESI A2, ATI TEAS 7, HESI EXIT, NCLEX-RN, NCLEX-PN, and Financial Literacy. Join Serrari Ed and start building your brighter future today.

Tankan Survey Shows Business Sentiment at Four-Year High

Adding to positive sentiment about Japan’s economic trajectory, a closely watched Bank of Japan survey showed on Monday that big Japanese manufacturers’ business sentiment hit a four-year high in the three months to December, providing strong support for the central bank’s anticipated interest rate increase. The quarterly “tankan” survey results suggest that despite the challenges posed by US tariffs and weak Chinese demand, Japan’s manufacturing sector has maintained resilience and confidence about future business conditions.

The measure of sentiment among large manufacturers in the tankan survey improved to its best level in four years, even after President Trump raised tariffs on goods from the US ally to a baseline level of 15 percent. The positive results exceeded analyst expectations and demonstrated that Japanese businesses have successfully adapted to the new tariff environment while maintaining optimistic outlooks for production and investment.

The measure of sentiment for all companies rose to 17 from 15 in the previous quarter, according to the survey results. The improvement “struck all the right notes from the Bank of Japan’s perspective,” according to Abhijit Surya of Capital Economics, who noted in a report that the survey “showed that business conditions are improving, profit margins remain elevated and firms are upbeat about their investment intentions.”

While the overall tankan survey showed improvement across sentiment metrics, forecasts for the next quarter were less positive, suggesting that businesses remain cautious about sustaining the current pace of recovery. Additionally, businesses expected inflation to remain at 2.4 percent, above the Bank of Japan’s 2 percent target range, indicating that price pressures continue to challenge policymakers despite some moderation from the peaks experienced earlier in the year.

Bank of Japan Rate Hike Widely Expected

With concerns over tariffs easing following the September trade agreement and economic data showing resilience, the Bank of Japan is widely expected to raise its short-term policy rate to 0.75 percent from 0.5 percent at its policy meeting concluding this week on December 18-19, although the pace of future rate hikes beyond this move remains subject to considerable uncertainty and debate among analysts and policymakers.

All 50 economists surveyed by Bloomberg expect the central bank to raise its benchmark rate to 0.75 percent at the December policy meeting, marking the first time every respondent has predicted a rate shift under Governor Kazuo Ueda’s leadership. This unanimous consensus reflects the combination of improving economic indicators, sustained inflation above target, and the central bank’s signaling that conditions are appropriate for continued monetary policy normalization.

The anticipated move would bring Japan’s policy rate to levels unseen in three decades, representing a significant milestone in the Bank of Japan’s gradual exit from the ultra-loose monetary policy that has characterized its approach for much of the past two decades. BOJ Governor Kazuo Ueda essentially pre-announced the move earlier in December, stating that the central bank would consider the “pros and cons” of increasing rates at the meeting and appearing to suggest that the conditions for a hike are now in place.

The stance of Prime Minister Sanae Takaichi’s Cabinet on monetary policy is seen as a key factor enabling the BOJ to proceed with the rate hike. Takaichi, known for her pro-monetary stimulus stance during her political career, has notably toned down her rhetoric and pressure on the Bank of Japan since taking office as prime minister in October, effectively giving the central bank political cover to pursue policy normalization.

Finance Minister Satsuki Katayama has effectively accepted the forthcoming BOJ rate hike, with one possible factor being the Takaichi Cabinet’s recognition that the prolonged weakening of the yen has been a major source of Japan’s elevated inflation. The prime minister has pledged to tackle the issue of price increases, and a stronger monetary policy stance could help support the currency and moderate import-driven inflation pressures.

Markets have almost fully priced in the chance of a rate hike to 0.75 percent from 0.5 percent at the December 18-19 meeting, with pricing suggesting roughly 90 percent probability of the move. The high degree of market anticipation reduces the risk of disruptive volatility when the decision is announced, though attention has shifted to how far the BOJ could raise rates before they reach a neutral level which neither stimulates nor cools economic growth.

Future Rate Path Remains Uncertain

The Bank of Japan will likely maintain a pledge to keep raising interest rates beyond the December meeting, but stress that the pace of further hikes will depend on how the economy reacts to each incremental increase, according to sources familiar with the central bank’s thinking. While the institution may internally update its estimate on how far its policy rate stands from levels deemed neutral, it will not use this estimate as a primary communication tool regarding the future rate-hike trajectory given the considerable difficulty of producing precise projections.

“Japan’s real interest rates are very low, allowing the BOJ to continue raising rates in several stages,” said one source familiar with the bank’s thinking, a view echoed by other sources who spoke on condition of anonymity. The central bank will seek to clarify that while neutral rate estimates are important guideposts in setting monetary policy, they would not constitute a decisive factor in determining the timing of the next rate increase after the December move.

According to Bank of America economist Takayasu Kudo, the Bank of Japan plans to incrementally raise its interest rates starting with the shift from 0.5 percent to 0.75 percent, with Japan’s improved corporate earnings and positive wage negotiations driving the decision. The bank reportedly intends to continue this trend with semi-annual rate hikes, suggesting further increases could occur in June 2026 and subsequent moves in 2027, though these projections remain subject to considerable uncertainty depending on economic developments.

With the rate action for December fully priced into markets, many BOJ watchers have indicated that the focus of the December policy meeting will center on any signals pointing to the pace of future rate increases and the likely peak for this hiking cycle. Former BOJ top economist Seisaku Kameda suggested the central bank will likely become more cautious than before in raising rates as they approach levels deemed neutral, noting that “the key message the BOJ must and will likely deliver upon raising rates to 0.75 percent is that monetary conditions will remain accommodative even after the move.”

Contrasting Monetary Policy Trajectories

The Bank of Japan’s movement toward higher interest rates stands in stark contrast to the monetary policy trajectory of the United States Federal Reserve, which has been trimming rates to counter a weak jobs market and signs of economic deceleration. This policy divergence between the world’s largest and third-largest economies creates interesting dynamics in currency markets and capital flows, with implications for global financial stability and trade balances.

Japan’s central bank is moving toward tighter monetary policy as it contends with persistent inflation running above the 2 percent target and a weak currency that has contributed to import-driven price pressures affecting household purchasing power. The yen’s prolonged weakness throughout 2025 has made imports more expensive, particularly for energy and raw materials that Japan depends on heavily, feeding into broader inflationary pressures across the economy.

Higher Japanese interest rates would likely lead domestic investors to shift funds back to Japan from overseas investments, potentially reducing demand for foreign assets including cryptocurrencies and emerging market bonds. The expectation of the BOJ rate hike caused bitcoin to dip below $88,000 from approximately $92,000 early Monday as markets anticipated that higher Japanese yields would make domestic investments more attractive relative to speculative assets.

Economic Context and Policy Implications

Japan has kept its key interest rate near or below zero for years, implementing an unprecedented monetary stimulus program designed to spur faster economic growth by keeping borrowing costs extremely low and encouraging businesses to invest and consumers to spend rather than save. The ultra-loose policy included negative interest rates, massive government bond purchases, and yield curve control mechanisms that represented some of the most aggressive monetary interventions attempted by any major central bank.

The gradual normalization of monetary policy represents a significant shift after decades of deflation and near-zero growth that plagued Japan’s economy. After ending its decade-long negative interest rate policy last year, the BOJ raised rates to 0.5 percent in January 2025 and has held steady since then while carefully monitoring economic conditions and assessing the appropriate pace for further increases.

Prime Minister Takaichi has pledged to revive the economy following the pattern established by her predecessors who made economic revitalization a central policy priority. Last month, her cabinet approved a 21.3 trillion yen ($135.4 billion) stimulus package designed to spur growth through expansionary government spending while providing relief from the impact of higher prices that have squeezed household budgets and dampened consumer sentiment.

The stimulus package represents a complementary approach to monetary policy tightening, with fiscal expansion supporting demand even as the central bank gradually withdraws monetary accommodation. This policy mix aims to achieve a soft landing where inflation moderates toward target levels without triggering recession or significantly damaging employment conditions.

Outlook and Remaining Challenges

While the November trade data and improved business sentiment provide encouraging signals about Japan’s economic resilience, significant challenges remain for policymakers navigating the path ahead. The persistent weakness in trade with China, Japan’s largest trading partner by total volume, represents a structural headwind that limits export growth potential and reflects deeper geopolitical tensions that show no signs of quick resolution.

Exports of semiconductors and electronic components continue to benefit from global demand tied to artificial intelligence applications and digital transformation initiatives, providing a bright spot in Japan’s export composition. However, traditional manufacturing sectors including automobiles face intensifying competition from Chinese and South Korean producers who have made significant technological advances while benefiting from lower production costs and aggressive government support.

The weak yen provides a competitive advantage for Japanese exporters but simultaneously creates inflationary pressures through higher import costs, presenting policymakers with difficult tradeoffs. Further interest rate increases by the Bank of Japan could strengthen the currency and help moderate inflation, but might also reduce export competitiveness and slow economic growth if implemented too aggressively or rapidly.

Labor market conditions remain relatively tight with shortages in key sectors supporting wage growth, though questions persist about whether the recent increases in nominal wages will translate into sustained improvements in real purchasing power once inflation is accounted for. The Bank of Japan has emphasized that it must assess whether firms’ active behavior regarding wages and investment will persist over time as a key consideration in future monetary policy decisions.

Looking ahead, Japan’s economic trajectory will depend heavily on external factors including the stability of the US-Japan trade relationship under the September framework agreement, China’s economic performance and willingness to maintain constructive trade relations, and global demand patterns particularly in technology sectors where Japan maintains competitive advantages. Domestically, the success of fiscal stimulus measures and the impact of gradual monetary policy normalization on consumer and business behavior will prove crucial in determining whether Japan can achieve sustained growth with stable inflation near the central bank’s 2 percent target.

Ready to take your career to the next level? Join our Online courses: ACCA, HESI A2, ATI TEAS 7 , HESI EXIT , NCLEX – RN and NCLEX – PN, Financial Literacy!🌟 Dive into a world of opportunities and empower yourself for success. Explore more at Serrari Ed and start your exciting journey today! ✨

Track GDP, Inflation and Central Bank rates for top African markets with Serrari’s comparator tool.

See today’s Treasury bonds and Money market funds movement across financial service providers in Kenya, using Serrari’s comparator tools.

photo source: Google

By: Montel Kamau

Serrari Financial Analyst

17th December, 2025

Article, Financial and News Disclaimer

The Value of a Financial Advisor

While this article offers valuable insights, it is essential to recognize that personal finance can be highly complex and unique to each individual. A financial advisor provides professional expertise and personalized guidance to help you make well-informed decisions tailored to your specific circumstances and goals.

Beyond offering knowledge, a financial advisor serves as a trusted partner to help you stay disciplined, avoid common pitfalls, and remain focused on your long-term objectives. Their perspective and experience can complement your own efforts, enhancing your financial well-being and ensuring a more confident approach to managing your finances.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Readers are encouraged to consult a licensed financial advisor to obtain guidance specific to their financial situation.

Article and News Disclaimer

The information provided on maincopy.serrarigroup.com is for general informational purposes only. While we strive to keep the information up to date and accurate, we make no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability, or availability with respect to the website or the information, products, services, or related graphics contained on the website for any purpose. Any reliance you place on such information is therefore strictly at your own risk.

maincopy.serrarigroup.com is not responsible for any errors or omissions, or for the results obtained from the use of this information. All information on the website is provided on an as-is basis, with no guarantee of completeness, accuracy, timeliness, or of the results obtained from the use of this information, and without warranty of any kind, express or implied, including but not limited to warranties of performance, merchantability, and fitness for a particular purpose.

In no event will maincopy.serrarigroup.com be liable to you or anyone else for any decision made or action taken in reliance on the information provided on the website or for any consequential, special, or similar damages, even if advised of the possibility of such damages.

The articles, news, and information presented on maincopy.serrarigroup.com reflect the opinions of the respective authors and contributors and do not necessarily represent the views of the website or its management. Any views or opinions expressed are solely those of the individual authors and do not represent the website's views or opinions as a whole.

The content on maincopy.serrarigroup.com may include links to external websites, which are provided for convenience and informational purposes only. We have no control over the nature, content, and availability of those sites. The inclusion of any links does not necessarily imply a recommendation or endorsement of the views expressed within them.

Every effort is made to keep the website up and running smoothly. However, maincopy.serrarigroup.com takes no responsibility for, and will not be liable for, the website being temporarily unavailable due to technical issues beyond our control.

Please note that laws, regulations, and information can change rapidly, and we advise you to conduct further research and seek professional advice when necessary.

By using maincopy.serrarigroup.com, you agree to this disclaimer and its terms. If you do not agree with this disclaimer, please do not use the website.

maincopy.serrarigroup.com, reserves the right to update, modify, or remove any part of this disclaimer without prior notice. It is your responsibility to review this disclaimer periodically for changes.

Serrari Group 2025