Kenya’s private sector economy concluded 2025 on a decidedly positive note, maintaining solid growth momentum through December despite a marginal deceleration from the previous month’s exceptional performance. The Stanbic Bank Kenya Purchasing Managers’ Index registered 53.7 in December, down from 55.0 in November but comfortably above the critical 50.0 threshold that separates expansion from contraction in business conditions.

The December reading represents the third consecutive month of expansion for Kenya’s private sector, capping a remarkable turnaround that began after months of challenging economic conditions earlier in the year. Readings above 50.0 denote growth in business activity, while those below indicate contraction, making the sustained performance above this benchmark particularly significant for Africa’s fourth-largest economy.

Build the future you deserve. Get started with our top-tier Online courses: ACCA, HESI A2, ATI TEAS 7, HESI EXIT, NCLEX-RN, NCLEX-PN, and Financial Literacy. Let Serrari Ed guide your path to success. Enroll today.

Employment Surge Marks Historic Milestone

Perhaps the most striking aspect of December’s PMI report was the employment growth hitting its highest rate since November 2019, representing the strongest hiring performance in more than six years. This acceleration marks a watershed moment for Kenya’s labor market, which has struggled with persistent unemployment and underemployment challenges throughout the post-pandemic period.

According to the comprehensive survey data compiled by S&P Global from responses to questionnaires sent to purchasing managers in a panel of around 400 private sector companies, job creation was widespread across sectors but most pronounced in the construction industry. The construction sector’s leadership in employment generation reflects both the government’s infrastructure push and increased private sector activity in real estate and related developments.

“Amid sharply increasing new business, firms in Kenya added to their workforces at a historically strong pace in December,” the Stanbic Bank report noted. “In fact, when adjusted for seasonal variation, the Employment Index rose to its highest point in just over six years.”

The employment acceleration followed renewed hiring in November, when firms resumed recruitment after a near freeze in October, thereby lifting staff numbers at a time when businesses were bracing for the cyclical, heightened festive-linked activity. The fresh hiring momentum aligns with a separate Central Bank of Kenya survey showing that chief executives expect to increase staffing levels in 2026, supported by easing financial conditions.

The CBK survey, covering chief executives and senior managers at 400 private sector firms, showed that 74% of banks and 42% of non-bank firms expect to increase staff in 2026. The hiring optimism is anchored on expectations that economic growth will strengthen in 2026, supported by recovering private sector credit, lower lending rates, and sustained macroeconomic stability.

Demand Dynamics and New Orders

The continued expansion in business activity was fundamentally driven by robust customer demand and increased new business volumes. Stanbic Bank economist Christopher Legilisho emphasized this point in his commentary on the December data, noting that “The Stanbic Bank Kenya PMI stayed in expansion territory, albeit slower this month, implying still strong demand conditions are driving new orders.”

Kenyan firms reported marked rises across multiple fronts—activity levels, sales volumes, and input purchases all registered significant increases. The strength of demand was particularly notable given that December typically marks the end of a challenging fiscal period and comes after months of economic adjustment following policy changes earlier in the year.

The sustained demand environment has prompted companies to increase their purchases and inventories to maintain competitiveness and facilitate faster deliveries to customers. This proactive approach to inventory management suggests that businesses expect the positive demand trends to continue into 2026, despite broader economic uncertainties.

Supplier delivery times improved significantly in December, reaching their best level since September 2021. This improvement in supply chain efficiency reflects both heightened competition among vendors and quicker fulfillment of urgent orders, creating a more responsive business environment that better serves customer needs.

Inflationary Pressures Re-emerge

While the overall business environment remained positive, December brought renewed inflationary pressures that warrant close monitoring as Kenya enters 2026. Input prices rose during the month due to increased tax burdens affecting certain categories of purchases, along with higher fuel and materials costs that rippled through supply chains.

“Inflationary pressures reaccelerated from November’s low, with input prices rising due to increased tax burdens and higher fuel and materials costs,” the PMI report detailed. However, the report also noted that “the overall rate of input price inflation remained softer than the long-run trend,” suggesting that while prices are rising, the pace remains manageable compared to historical norms.

The acceleration in cost burdens came as sustained growth in new orders and business activity prompted the fastest expansion in input buying in several months. This pick-up in purchasing activity reflects businesses’ confidence in future demand and their willingness to invest in inventory even as costs rise.

Output prices also rose modestly in December, as firms sought to pass some of their increased costs onto customers. The survey highlighted that these selling price increases represented the sharpest pace in 12 months, indicating that businesses are finding some pricing power in the current market environment. However, wage costs saw only a fractional increase, pointing to potential inflationary pressures ahead as labor markets tighten.

Legilisho cautioned that “Overall, this suggests that we could see higher inflation in the coming months from improving consumer demand as firms become more confident.” This projection aligns with broader economic indicators showing that Kenya’s inflation stood at 4.5% in November and December 2025, well within the Central Bank of Kenya’s target band of 5±2.5%.

Context: Kenya’s Economic Performance in 2025

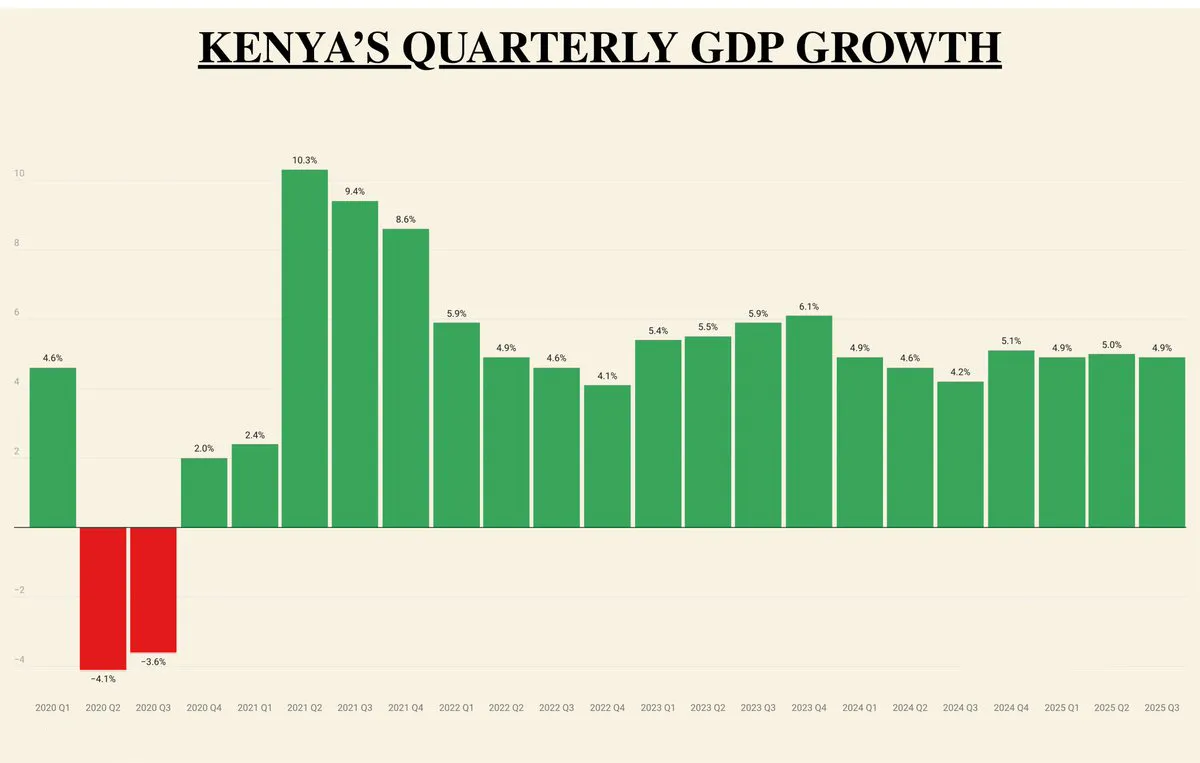

The December PMI data caps a year of gradual economic recovery for Kenya, which navigated significant fiscal and monetary policy adjustments while maintaining growth momentum. Kenya’s economy grew by 4.9% year-on-year in the third quarter of 2025, up from 4.2% in the same period of 2024, according to data from the Kenya National Bureau of Statistics.

The stronger performance was driven mainly by agriculture and construction sectors. The construction sector rebounded sharply, expanding by 6.7% in the third quarter of 2025 after contracting by 2.6% in the same quarter of 2024. Agriculture, forestry, and fishing grew by 3.2%, while mining and quarrying recovered strongly, expanding by 16.6% after a contraction of 12.2% a year earlier.

For the full year 2024, Kenya’s real Gross Domestic Product grew by 4.7%, compared to a revised growth of 5.7% in 2023, according to the Kenya National Bureau of Statistics. The growth was noted in most sectors of the economy, with Agriculture, Forestry and Fishing growing by 4.6% compared to 6.6% growth in 2023. Other sectors recorded notable growth including Financial & Insurance Activities (7.6%), Transportation and Storage (4.4%), and Real Estate (5.3%).

Looking ahead, the World Bank projects Kenya’s economy to grow by an average of 4.9% between 2025 and 2027, an increase from previous estimates. The government’s own macro-fiscal framework projects real GDP growth at about 5.3% in both 2025 and 2026, reflecting modest optimism about the country’s economic trajectory.

Monetary Policy Support

A crucial enabler of the private sector’s improved performance has been the Central Bank of Kenya’s accommodative monetary policy stance. The CBK has systematically lowered its policy rate during 2025 in response to subdued inflationary pressures and improving exchange rate stability. In December 2025, the Monetary Policy Committee cut the Central Bank Rate by 25 basis points to 9.00%, down from 9.25%.

The rate cuts have been intended to revive private sector lending and investment, with lower benchmark rates translating into falling commercial lending rates. By September 2025, private sector credit growth had turned positive year-on-year after months of contraction, demonstrating that the monetary easing is beginning to achieve its intended effects.

The CBK reported that Kenya’s economy remained resilient in the first half of 2025, posting an average GDP growth of 4.9%. Strong performance in the industrial sector, stable agriculture, and a robust services sector supported the expansion. Officials project further growth to 5.2% in 2025 and 5.5% in 2026, driven by continued recovery across key sectors.

The central bank’s accommodative stance has been made possible by inflation remaining well-contained. Kenya’s inflation continued to ease, falling to 4.5% in November 2025 from 4.6% in October, well below the midpoint of the CBK’s target band. Core inflation dropped to 2.3%, helped by cheaper processed foods such as sugar and maize flour. The MPC expects inflation to stay near the lower end of the target range in the coming months due to stable energy costs, a steady exchange rate, and moderated food prices.

November’s Exceptional Performance Provides Context

To fully appreciate December’s 53.7 PMI reading, it’s important to understand the exceptional nature of November’s performance. The headline PMI rose to 55.0 in November from 52.5 in October, representing Kenya’s private sector’s fastest growth in five years. This surge was driven by the fastest rise in new orders in over five years, as firms reported improved customer purchasing power and strong responses to new product launches and aggressive marketing campaigns.

Business activity in November expanded at a similarly rapid pace, with output rising at the sharpest rate since late 2020. Companies increased their procurement of inputs and accelerated hiring to meet rising workloads, pushing employment to its second-fastest growth level in over two years at that time.

The November report showed that inflationary pressures remained mild, with input costs rising at the slowest pace in 18 months. Selling prices increased only slightly, as easing cost burdens allowed firms to maintain competitive output charges. This benign inflation environment provided businesses with the confidence to expand operations without fear of cost spirals.

Christopher Legilisho, commenting on November’s data, said the improvement pointed to a meaningful turnaround in private sector momentum. “The stimulus measures implemented over the past year are now filtering through to the real economy. Firms are responding directly to the stronger demand environment.”

Sectoral Performance and Composition

The PMI survey covers five major sectors of Kenya’s economy, providing a comprehensive view of private sector conditions across different industries. While the December data showed broad-based growth, certain sectors outperformed others, reflecting both cyclical factors and structural changes in the Kenyan economy.

The construction sector’s leadership in employment generation during December aligns with broader trends visible in the quarterly GDP data. Construction rebounded sharply in Q3 2025, expanding by 6.7% after contracting by 2.6% in the same quarter of 2024. This recovery reflects both government infrastructure investment and renewed private sector confidence in real estate development.

Other sectors that recorded notable growth in Q3 2025 included Accommodation & Food Serving (17.7%), Real Estate (5.7%), Financial & Insurance (5.4%), Transport and Storage (5.2%), Public Administration (5.1%), Wholesale and Retail Trade (4.8%), and Information & Communication (4.5%). These strong performances across diverse sectors demonstrate the broad-based nature of Kenya’s economic recovery.

The services sector, which accounts for a substantial portion of Kenya’s GDP and employment, has maintained its central role in driving economic activity. Services performance has been particularly important given Kenya’s positioning as East Africa’s commercial and financial hub, with Nairobi serving as a regional center for banking, telecommunications, technology, and professional services.

One decision can change your entire career. Take that step with our Online courses in ACCA, HESI A2, ATI TEAS 7, HESI EXIT, NCLEX-RN, NCLEX-PN, and Financial Literacy. Join Serrari Ed and start building your brighter future today.

Business Expectations and Investment Plans

A particularly encouraging aspect of the December PMI data was the positive outlook expressed by surveyed businesses for 2026. Business expectations remained positive, buoyed by plans for investment, diversification, and increased advertising. According to the survey, a fifth of firms expressed confidence for increased output in 2026, driven by anticipated growth in investment, staffing expansion, diversification initiatives, product rebrands, and increased marketing expenditure.

This forward-looking optimism suggests that businesses believe the current recovery has legs and that the favorable demand conditions observed in recent months will persist. The willingness of firms to commit to expansion through hiring, capital investment, and marketing spend indicates genuine confidence rather than merely hoping for the best.

The investment plans span multiple areas. Some firms are focusing on capacity expansion to meet growing demand, while others are pursuing diversification strategies to reduce risk and tap into new market opportunities. Product rebranding initiatives suggest businesses are adapting to changing consumer preferences and positioning themselves for competitive advantage.

Increased advertising budgets signal that companies believe consumer purchasing power is sufficiently robust to justify marketing investments. This is particularly significant given that Kenya, like many African economies, saw consumer spending pressured during recent years by inflation, currency pressures, and economic uncertainty.

Labor Market Implications

The employment gains recorded in December, while impressive, must be viewed within the broader context of Kenya’s persistent labor market challenges. While the PMI’s Employment Index rose to its highest point in over six years, Kenya continues to grapple with the structural challenge of creating sufficient high-quality formal sector jobs to absorb its growing workforce.

World Bank and KNBS data show that Kenya added 782,300 new jobs in 2024 across the modern and informal sectors (excluding small-scale agriculture). Yet only 78,600 jobs, about 10%, were formal, while 703,700, or 90%, were generated in the informal economy. This pushed total employment from 20.0 million in 2023 to 20.8 million in 2024, a significant rise but one dominated by non-wage, insecure work.

The formal-informal employment imbalance highlights a fundamental disconnect between GDP growth rates and the quality of employment being created. Even as Kenya’s economy has expanded at rates around 4-5% annually, the structural transformation needed to generate mass formal employment has proceeded slowly.

Wage data reflects this tension. The Kenya National Bureau of Statistics shows the nominal wage bill grew 7.2% to Sh2.998 trillion in 2024, with the private sector accounting for 70.6%. Average annual earnings in the formal sector increased, but wage growth has not kept pace with productivity gains or matched the aspirations of Kenya’s young, increasingly educated workforce.

The government’s own projections acknowledge that output growth of 5.8% per year is needed to absorb the 680,000 people entering the labor market annually. With accelerated structural transformation, GDP growth of 7.3% could create 1.36 million new jobs and cut unemployment to 7%. Achieving this requires improving governance, infrastructure, human capital development, access to finance, and macroeconomic stability.

Fiscal Context and Constraints

Kenya’s private sector recovery has unfolded against a backdrop of significant fiscal pressures that have shaped both government policy and the broader business environment. Public debt remains high, with the government targeting a fiscal deficit of 4.5% of GDP for the 2025/26 financial year as part of its consolidation strategy.

The World Bank has noted that fiscal pressures are intensifying, with the FY2024/25 deficit widening to 5.9% of GDP—above the original 4.3% target—driven mostly by revenue shortfalls. High levels of government borrowing over recent years have placed pressure on private sector credit, limiting access to financing for businesses and entrepreneurs.

Debt servicing currently absorbs a substantial portion of tax revenues, leaving limited fiscal space for new public investments or countercyclical spending. This constraint means that private sector-led growth has become even more critical to Kenya’s economic performance, as the government has less capacity to drive growth through fiscal stimulus.

The tax measures that contributed to December’s input cost increases reflect the government’s efforts to boost revenue collection as part of its fiscal consolidation program. While necessary from a fiscal sustainability perspective, these measures add to business costs and create headwinds for profitability and investment.

Global and Regional Context

Kenya’s private sector performance in late 2025 must also be understood within its global and regional contexts. The Central Bank of Kenya reported that the global economy continues expanding, with growth estimated at 3.2% in 2025. Strong consumer spending and improved financial conditions in major economies, especially the United States, continue to support global performance.

However, the CBK warned that global growth could ease slightly to 3.1% in 2026, citing higher trade tariffs, geopolitical tensions in the Middle East and Europe, and weaker international demand. These external headwinds could affect Kenya through multiple channels, including reduced demand for exports, volatile commodity prices, and potential disruptions to remittance flows.

For Kenya, export performance has been moderately positive. Exports rose by 6.7% in the 12 months to October 2025, driven by stronger demand for horticulture, coffee, manufactured goods, and apparel. Services earnings and diaspora remittances also increased, providing crucial foreign exchange inflows.

However, Kenya’s current account deficit widened to 2.2% of GDP in the 12 months to October 2025, up from 1.5% in 2024, as higher imports of intermediate and capital goods pushed the gap wider. The widening current account deficit reflects both the recovery in business investment (which requires imported capital goods) and continued dependence on imported inputs for manufacturing and construction.

Within East Africa, Kenya maintains its position as the region’s largest economy, though competition and economic dynamics are evolving. The country’s services-oriented economy, relatively developed financial sector, and position as a regional hub provide advantages, but also create vulnerabilities to financial sector stress and demand shocks affecting regional trade and investment flows.

Risks and Challenges Ahead

Despite the positive momentum captured in December’s PMI data, several risks and challenges cloud the outlook for 2026. The modest deceleration from November’s exceptional 55.0 reading to December’s 53.7, while still indicative of solid growth, suggests that sustaining the pace of expansion may prove challenging.

Inflationary pressures represent perhaps the most immediate concern. The reacceleration of input cost inflation in December, combined with rising output prices and the potential for wage pressures as labor markets tighten, could push overall inflation higher in coming months. If inflation accelerates beyond the Central Bank’s target range, it could force a reversal of monetary easing, with higher interest rates dampening the very demand that has been driving the private sector recovery.

Weather-related risks remain ever-present for Kenya’s economy, particularly given agriculture’s continued importance both directly and through its effects on food prices and rural purchasing power. Adverse weather conditions—whether drought or excessive rainfall—could disrupt agricultural production, trigger food price spikes, and dampen both rural and urban demand.

Global economic uncertainties, including trade policy developments in major economies, geopolitical tensions, and potential financial market volatility, could affect Kenya through multiple transmission channels. Any significant deterioration in the global growth outlook would likely impact demand for Kenyan exports, remittance flows, foreign direct investment, and access to international capital markets.

The structural challenges facing Kenya’s economy—including the quality of employment creation, fiscal constraints, infrastructure gaps, and governance issues—will not be resolved quickly. While the PMI data suggests cyclical improvement, achieving and sustaining higher growth rates that create sufficient quality employment will require addressing these deeper structural factors.

Policy Implications and Way Forward

The December PMI data, while showing some moderation from November’s exceptional performance, paints a picture of an economy with genuine momentum heading into 2026. For policymakers, the challenge will be nurturing this recovery while managing emerging inflationary pressures and maintaining fiscal discipline.

The Central Bank of Kenya faces a delicate balancing act. Its accommodative monetary policy has clearly supported the private sector recovery, with lower interest rates facilitating the credit growth that has enabled businesses to invest and expand. However, if inflationary pressures continue building, the CBK may need to pause or even reverse its easing cycle to maintain price stability.

For fiscal policymakers, the positive PMI data provides some validation that the economy is resilient enough to handle the consolidation measures being implemented. However, the challenge remains to pursue fiscal sustainability without undermining the recovery through excessive austerity or poorly designed tax measures that create significant disincentives for business activity.

The government’s infrastructure investment plans, if executed effectively, could provide crucial support to continued private sector expansion by addressing bottlenecks in transportation, energy, and other key sectors. However, fiscal constraints mean that maximizing the efficiency and impact of public investment becomes even more critical.

For businesses, the current environment presents both opportunities and challenges. Strong demand conditions and improving supply chain efficiency create favorable conditions for growth and profitability. However, rising input costs, potential wage pressures, and ongoing economic uncertainties require careful management and planning.

The employment gains recorded in December are particularly encouraging from a social and economic perspective. If sustained, stronger job creation could help address one of Kenya’s most pressing challenges—providing productive employment for its young, growing workforce. However, translating employment growth into higher-quality formal sector jobs will require continued efforts to improve the business environment, skills development, and labor market functioning.

Conclusion: Cautious Optimism for 2026

Kenya’s private sector concluded 2025 on a demonstrably positive note, with the December PMI reading of 53.7 indicating continued expansion despite a slight moderation from November’s five-year high. The employment surge to levels last seen in November 2019 represents a particularly encouraging signal, suggesting that businesses have sufficient confidence in future demand to commit to workforce expansion.

The underlying drivers of the expansion—robust customer demand, rising new orders, and improved business activity—point to genuine momentum rather than merely seasonal or temporary factors. The willingness of firms to increase inventories and accelerate purchases reflects confidence that the positive trends will persist into 2026.

However, the re-emergence of inflationary pressures and the modest deceleration from November’s reading serve as reminders that the recovery faces headwinds. Managing the balance between supporting growth and controlling inflation will be crucial for sustaining the expansion through 2026 and beyond.

As Kenya enters 2026, the private sector appears to be in its strongest position in several years, with employment growing, demand holding firm, and business confidence elevated. Whether this momentum can be sustained and translated into the higher, more inclusive growth that Kenya needs will depend on the complex interplay of domestic policy choices, external conditions, and the country’s ability to address its structural economic challenges while navigating cyclical pressures.

The December PMI data provides grounds for cautious optimism that Kenya’s private sector can build on the recovery momentum established in late 2025. However, translating this cyclical improvement into sustained, structural transformation that creates quality jobs and raises living standards for Kenya’s 50+ million people remains the longer-term challenge that will define the country’s economic success in the years ahead.

Ready to take your career to the next level? Join our Online courses: ACCA, HESI A2, ATI TEAS 7 , HESI EXIT , NCLEX – RN and NCLEX – PN, Financial Literacy!🌟 Dive into a world of opportunities and empower yourself for success. Explore more at Serrari Ed and start your exciting journey today! ✨

Track GDP, Inflation and Central Bank rates for top African markets with Serrari’s comparator tool.

See today’s Treasury bonds and Money market funds movement across financial service providers in Kenya, using Serrari’s comparator tools.

photo source: Google

By: Montel Kamau

Serrari Financial Analyst

7th January, 2026

Article, Financial and News Disclaimer

The Value of a Financial Advisor

While this article offers valuable insights, it is essential to recognize that personal finance can be highly complex and unique to each individual. A financial advisor provides professional expertise and personalized guidance to help you make well-informed decisions tailored to your specific circumstances and goals.

Beyond offering knowledge, a financial advisor serves as a trusted partner to help you stay disciplined, avoid common pitfalls, and remain focused on your long-term objectives. Their perspective and experience can complement your own efforts, enhancing your financial well-being and ensuring a more confident approach to managing your finances.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Readers are encouraged to consult a licensed financial advisor to obtain guidance specific to their financial situation.

Article and News Disclaimer

The information provided on maincopy.serrarigroup.com is for general informational purposes only. While we strive to keep the information up to date and accurate, we make no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability, or availability with respect to the website or the information, products, services, or related graphics contained on the website for any purpose. Any reliance you place on such information is therefore strictly at your own risk.

maincopy.serrarigroup.com is not responsible for any errors or omissions, or for the results obtained from the use of this information. All information on the website is provided on an as-is basis, with no guarantee of completeness, accuracy, timeliness, or of the results obtained from the use of this information, and without warranty of any kind, express or implied, including but not limited to warranties of performance, merchantability, and fitness for a particular purpose.

In no event will maincopy.serrarigroup.com be liable to you or anyone else for any decision made or action taken in reliance on the information provided on the website or for any consequential, special, or similar damages, even if advised of the possibility of such damages.

The articles, news, and information presented on maincopy.serrarigroup.com reflect the opinions of the respective authors and contributors and do not necessarily represent the views of the website or its management. Any views or opinions expressed are solely those of the individual authors and do not represent the website's views or opinions as a whole.

The content on maincopy.serrarigroup.com may include links to external websites, which are provided for convenience and informational purposes only. We have no control over the nature, content, and availability of those sites. The inclusion of any links does not necessarily imply a recommendation or endorsement of the views expressed within them.

Every effort is made to keep the website up and running smoothly. However, maincopy.serrarigroup.com takes no responsibility for, and will not be liable for, the website being temporarily unavailable due to technical issues beyond our control.

Please note that laws, regulations, and information can change rapidly, and we advise you to conduct further research and seek professional advice when necessary.

By using maincopy.serrarigroup.com, you agree to this disclaimer and its terms. If you do not agree with this disclaimer, please do not use the website.

maincopy.serrarigroup.com, reserves the right to update, modify, or remove any part of this disclaimer without prior notice. It is your responsibility to review this disclaimer periodically for changes.

Serrari Group 2025